On June 8, 2020, the Internal Revenue Service (IRS) issued Notice 2020-44 announcing the PCORI fee for plan years ending on or after October 1, 2019 and before October 1, 2020 will be $2.54 per covered life and is due July 31, 2020. The Further Consolidated Appropriations Act of 2020 included a 10 year extension of the PCORI fees originally … Read More

IRS Issues COVID-19 Guidance for Cafeteria Plans

Due to the COVID-19 crisis, the IRS has issued Notice 2020-29 to announce the opportunity for employers to allow mid-year changes to employer-sponsored health coverage and dependent care assistance program elections (listed below). The notice also allows employers the option to extend health and dependent care FSA grace periods that would have ended earlier in 2020, in order to make … Read More

2021 HSA Limits and ACA Out-Of-Pocket Maximums

The IRS has issued Revenue Procedure 2020-32 to announce the 2021 contribution limits and high deductible health plan (HDHP) design requirements. The new Health Savings Account (HSA) contribution limits will become effective January 1, 2021, and the new HDHP design requirements will go into effect on the first day of plan years beginning on or after January 1, 2021. … Read More

Year-end Congressional Spending Bill Repeals ACA Taxes and Extends PCORI Fee

As part of a year-end spending bill that was signed in law last Friday, Congress passed a repeal of several ACA taxes, an extension of the PCORI fee, and a number of revisions to retirement savings plans. Foster & Foster outlined changes to employer-sponsored and individual retirement accounts here. Below, we highlight several changes relevant to health plans: Permanent repeal … Read More

Foster & Foster Expands Plan Administration Services to Illinois Fire and Police Pension Funds

Foster & Foster’s Plan Administration Division was established in Fort Myers, FL in 2013 and currently provides third-party administration services to over 40 Florida pension plans. The administrative responsibilities vary based on client needs, but may include services such as: Administration of Meetings – Prepare Meeting Agendas, Packets and Minutes Facilitation of Trustee Elections and Annual Affidavits Certifying Pension Eligibility … Read More

IRS Announces 2020 Flexible Spending Arrangement (FSA) Contribution Limit

The Internal Revenue Service (IRS) has announced that the 2020 limit on employee pre-tax FSA contributions will rise to $2,750, up from $2,700 in 2019. Revenue Procedure Bulletin 2019-44 provides the details of this and approximately sixty other tax-related annual inflation adjustments. The dependent care FSA maximum, which is set by statute and not subject to inflation-related adjustments, will remain … Read More

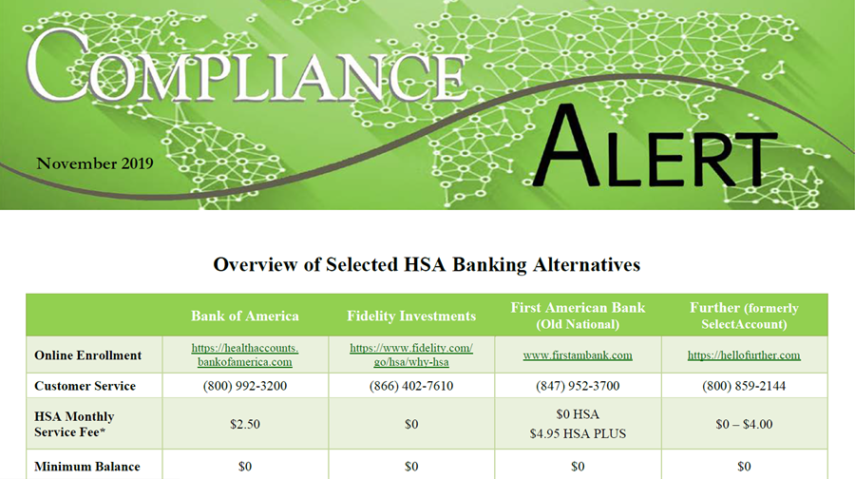

Overview of Selected HSA Banking Alternatives

We’re frequently asked which is “the best” HSA bank for our clients’ employees, but it’s not an easy answer. Lately, employers are moving away from using traditional banks and toward online or investment banks to take advantage of longer term investment options and online fund access. Increasingly, employers are even pairing their HSA with their retirement savings vendor to help … Read More