The Internal Revenue Service (IRS) recently released the 1094-C/1095-C forms and instructions to be used by Applicable Large Employers (ALEs) for the 2018 tax year reporting required by the Affordable Care Act (ACA). ALEs sponsoring a self-funded health plan may use Part III of Form 1095-C to provide individual coverage information to plan participants in lieu of providing Form 1094-B, … Read More

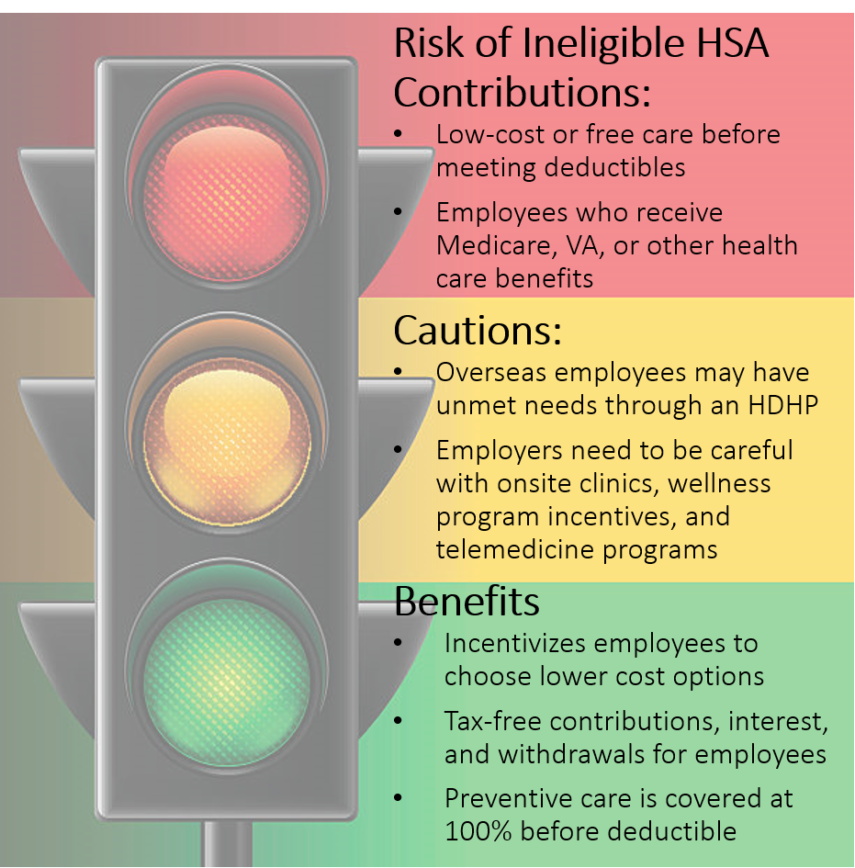

Cautions and Benefits of an HDHP/HSA for Your Organization

As the price of health care continues to increase faster than the rate of inflation, both monthly premiums and average deductibles are also increasing. Many employers have turned to high deductible health plans (HDHPs) to reduce premiums. When paired with a Health Savings Account (HSA), an HDHP can save employees money on their monthly premiums and allow them to pay … Read More

ACA Affordability Threshold Increases in 2019

In order to determine coverage affordability under the Affordable Care Act (ACA), the IRS sets an “affordability percentage” annually. The affordability percentage is applied to the employee’s annual household income and the result is divided by 12 in order to determine the maximum “affordable” monthly contribution. Coverage is deemed to have met the ACA’s affordability standard if the employee cost for … Read More

Managing Prescription Drug Plan Costs: Pricing Tricks Employers Should Watch For

Employers typically pay close attention to medical plan provider discounts, stop loss premiums, and administrative costs, but often overlook ways to manage prescription drug plan costs. Proactively controlling prescription drug costs in your self-funded group health plan can save your organization up to $40 per employee per month through better-negotiated pricing alone. For a 500-employee group, this amounts to over … Read More

Are you Prepared for a HIPAA Audit?

The Health Insurance Portability and Accountability Act (HIPAA) protects the privacy and security of an individual’s protected health information (PHI) by governing how covered entities use, store, and share health information. As covered entities under HIPAA, self-funded plan sponsors must comply with HIPAA’s Privacy, Security, and Breach Notification Rules. The Department of Health and Human Services Office of Civil Rights … Read More