As part of a year-end spending bill that was signed in law last Friday, Congress passed a repeal of several ACA taxes, an extension of the PCORI fee, and a number of revisions to retirement savings plans. Foster & Foster outlined changes to employer-sponsored and individual retirement accounts here. Below, we highlight several changes relevant to health plans: Permanent repeal … Read More

SECURE Act Signed into Law

Last week saw the U.S. Senate pass an omnibus spending bill, which President Trump signed into law on Friday. Attached to this bill was the Setting Every Community Up for Retirement Enhancement Act (SECURE Act), which would make changes to both employer-sponsored retirement plans and individual retirement accounts, most notably: Expand the ability of employers to partner together to offer … Read More

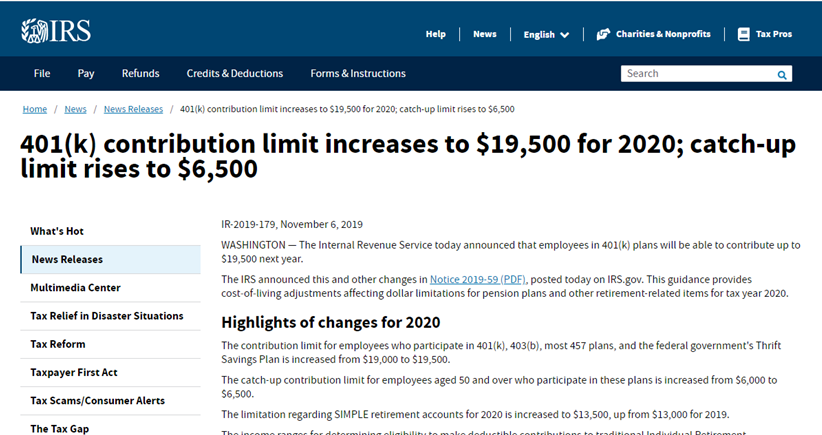

IRS Announces Updates to 2020 Retirement Plan Limits

Each year the IRS provides cost of living adjustments to benefit plan limits to assist sponsors in administering their plans. On November 6, the IRS released Notice 2019-59, which provided 2020 limits for retirement plans. Information on the release can be found here. Some of the key limits are shown below, along with the increase in the Social Security taxable … Read More