IRS Issues New Mortality Table Regulations Effective January 1, 2024

November 4, 2023ARPA Includes Key Funding Relief Provisions

March 19, 2021Patient-Centered Outcomes Research Institute (PCORI) Fees Due July 31, 2020

On June 8, 2020, the Internal Revenue Service (IRS) issued Notice 2020-44 announcing the PCORI fee for plan years ending on or after October 1, 2019 and before October 1, 2020 will be $2.54 per...

Read moreIRS Issues COVID-19 Guidance for Cafeteria Plans

Due to the COVID-19 crisis, the IRS has issued Notice 2020-29 to announce the opportunity for employers to allow mid-year changes to employer-sponsored health coverage and dependent care assistance...

Read more2021 HSA Limits and ACA Out-Of-Pocket Maximums

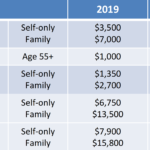

The IRS has issued Revenue Procedure 2020-32 to announce the 2021 contribution limits and high deductible health plan (HDHP) design requirements. The new Health Savings Account (HSA) contribution...

Read moreYear-end Congressional Spending Bill Repeals ACA Taxes and Extends PCORI Fee

As part of a year-end spending bill that was signed in law last Friday, Congress passed a repeal of several ACA taxes, an extension of the PCORI fee, and a number of revisions to retirement savings...

Read moreOverview of Selected HSA Banking Alternatives

We’re frequently asked which is “the best” HSA bank for our clients’ employees, but it’s not an easy answer. Lately, employers are moving away from using traditional...

Read moreChanges to the ACA Affordability Standard for 2020

Recently, the IRS issued Revenue Procedure Bulletin 2019-29, which decreases the affordability percentage under the Employer Mandate. The “affordability standard” is a component of ACA that is...

Read more2020 HSA Limits and ACA Out-Of-Pocket Maximums

The IRS has issued Revenue Procedure 2019-25 to announce the 2020 contribution limits and high deductible health plan (HDHP) design requirements. The new HSA contribution limits will become effective...

Read more