The Internal Revenue Service (IRS) has announced that the 2019 limit on employee pre-tax FSA healthcare contributions will rise to $2,700, up from $2,650 in 2018. Revenue Procedure Bulletin 2018-57 provides the details of this and approximately fifty other tax-related annual inflation adjustments. The dependent care FSA maximum, which is set by statute and not subject to inflation-related adjustments, will … Read More

The IRS Releases Final 1094-C/1095-C Forms and Instructions for 2018 Tax Year

The Internal Revenue Service (IRS) recently released the 1094-C/1095-C forms and instructions to be used by Applicable Large Employers (ALEs) for the 2018 tax year reporting required by the Affordable Care Act (ACA). ALEs sponsoring a self-funded health plan may use Part III of Form 1095-C to provide individual coverage information to plan participants in lieu of providing Form 1094-B, … Read More

IRS Announces Updates to 2019 Retirement Plan Limits

Each year the IRS provides cost-of-living adjustments to benefit plan limits to assist sponsors in administering their plans. On November 1, the IRS released Notice 2018-83, which provided 2019 limits for retirement plans. Information on the release can be found here. Some of the key limits are shown below, along with the increase in the Social Security taxable wage base … Read More

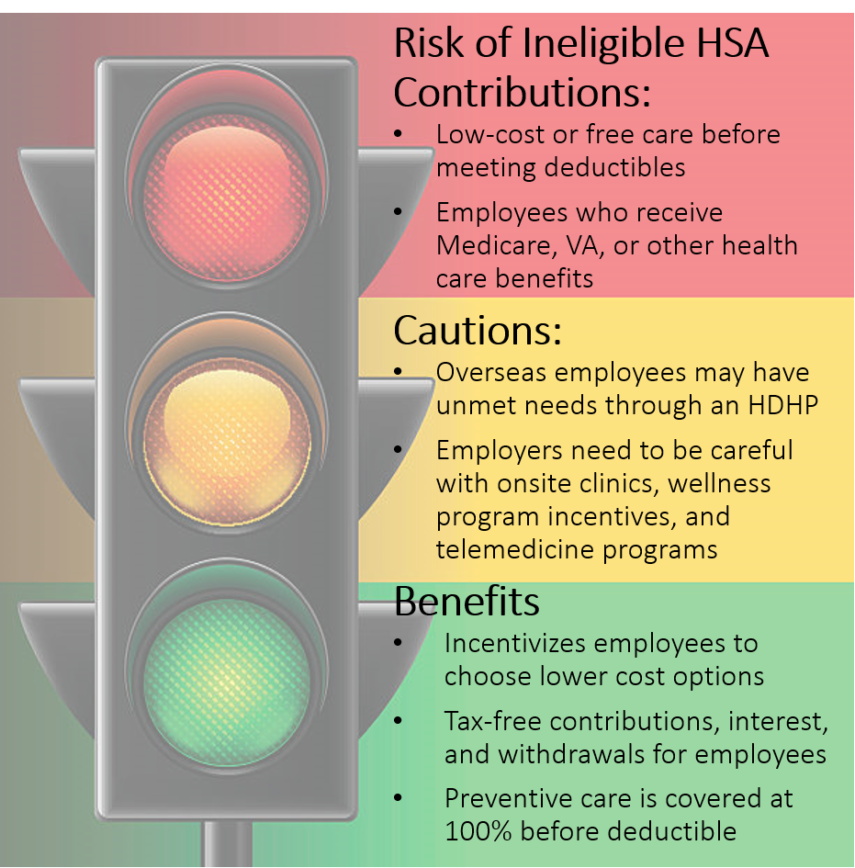

Cautions and Benefits of an HDHP/HSA for Your Organization

As the price of health care continues to increase faster than the rate of inflation, both monthly premiums and average deductibles are also increasing. Many employers have turned to high deductible health plans (HDHPs) to reduce premiums. When paired with a Health Savings Account (HSA), an HDHP can save employees money on their monthly premiums and allow them to pay … Read More