Last week, Judge Reed C. O’Connor ruled in favor of a lawsuit that argued the entirety of the Affordable Care Act (ACA) is unconstitutional without the individual mandate. The individual mandate penalty was eliminated starting in 2019 by the tax bill passed by Congress in December 2017. Despite this ruling, there will be no immediate change to the numerous provisions … Read More

The IRS Extends the Deadline for Furnishing Forms 1095-B and 1095-C to Individuals

The IRS has extended the deadline for furnishing Forms 1095-B and 1095-C to individuals from January 31, 2019 to March 4, 2019. Notice 2018-94 DOES NOT extend the deadlines for filing the 2018 Forms 1094-B, 1095-B, 1094-C, or 1095-C with the IRS. The due date for filing with the IRS remains February 28, 2019 for paper forms, or April 1, … Read More

IRS Announces 2019 Healthcare Flexible Spending Arrangement (FSA) Contribution Limit

The Internal Revenue Service (IRS) has announced that the 2019 limit on employee pre-tax FSA healthcare contributions will rise to $2,700, up from $2,650 in 2018. Revenue Procedure Bulletin 2018-57 provides the details of this and approximately fifty other tax-related annual inflation adjustments. The dependent care FSA maximum, which is set by statute and not subject to inflation-related adjustments, will … Read More

The IRS Releases Final 1094-C/1095-C Forms and Instructions for 2018 Tax Year

The Internal Revenue Service (IRS) recently released the 1094-C/1095-C forms and instructions to be used by Applicable Large Employers (ALEs) for the 2018 tax year reporting required by the Affordable Care Act (ACA). ALEs sponsoring a self-funded health plan may use Part III of Form 1095-C to provide individual coverage information to plan participants in lieu of providing Form 1094-B, … Read More

IRS Announces Updates to 2019 Retirement Plan Limits

Each year the IRS provides cost-of-living adjustments to benefit plan limits to assist sponsors in administering their plans. On November 1, the IRS released Notice 2018-83, which provided 2019 limits for retirement plans. Information on the release can be found here. Some of the key limits are shown below, along with the increase in the Social Security taxable wage base … Read More

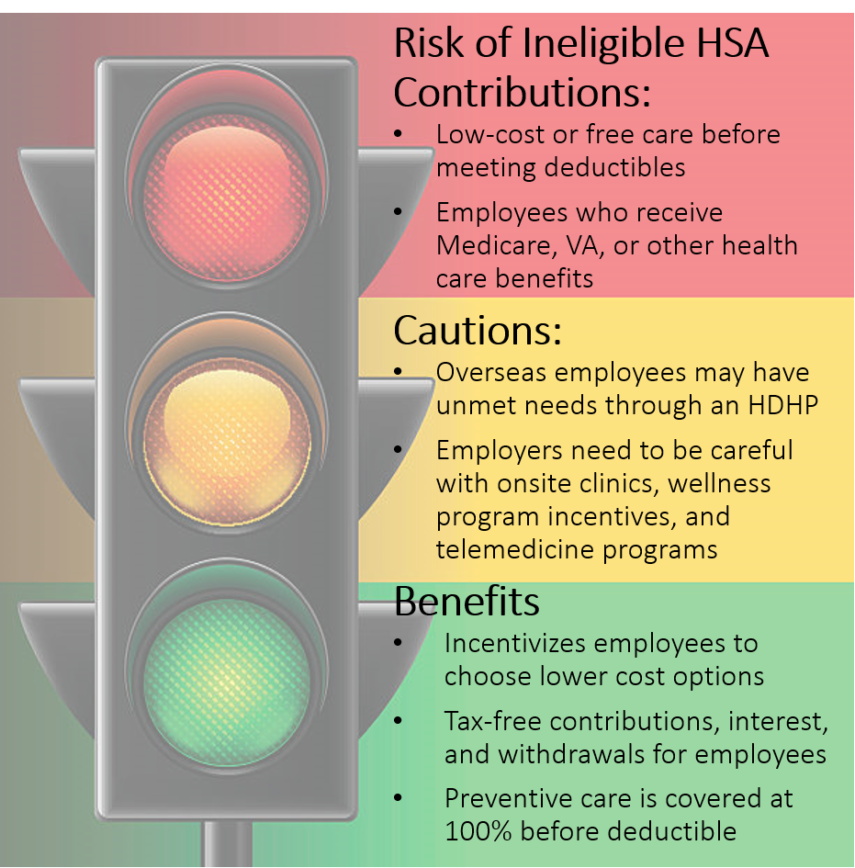

Cautions and Benefits of an HDHP/HSA for Your Organization

As the price of health care continues to increase faster than the rate of inflation, both monthly premiums and average deductibles are also increasing. Many employers have turned to high deductible health plans (HDHPs) to reduce premiums. When paired with a Health Savings Account (HSA), an HDHP can save employees money on their monthly premiums and allow them to pay … Read More

SOA Releases Mortality Improvement Scale MP-2018

When the Society of Actuaries (SOA) released the RP-2014 mortality table in 2014, they included mortality improvement scale MP-2014. The purpose of this scale is to reflect mortality improvement into the future, since one would expect future mortality rates to be lower with further advances in health and medicine. A practice was then started to update this improvement scale annually … Read More

Foster & Foster Reviews Exposure Draft of Pub-2010 Public Retirement Plans Mortality Tables Report

As mentioned in our August 28th Retirement Blog, an exposure draft of mortality tables based on public retirement plan experience has been released by the Society of Actuaries and the Retirement Plans Experience Committee (“RPEC”). We have completed our review of the draft and will summarize our findings in this post. Highlights The study was based on data gathered from … Read More

Executive Order to Strengthen Retirement Security

On August 31, 2018, President Trump released an Executive Order on “Strengthening Retirement Security in America.” You can see the text here. The Order outlines the issue of low workplace retirement plan coverage and seeks to ease the regulatory burdens that might prevent employers from offering such solutions. The Order specifically directs the Secretaries of Labor and Treasury to explore … Read More