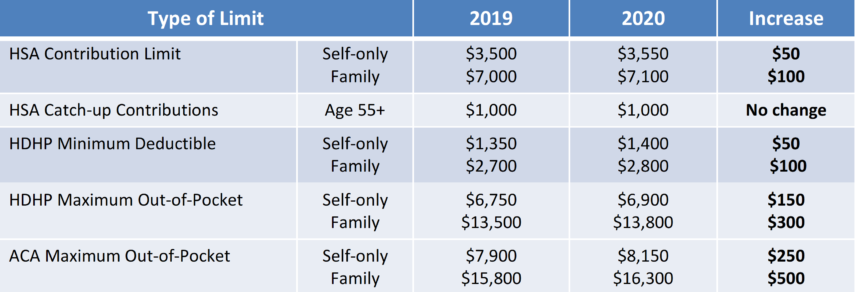

The IRS has issued Revenue Procedure 2019-25 to announce the 2020 contribution limits and high deductible health plan (HDHP) design requirements. The new HSA contribution limits will become effective January 1, 2020 and the new HDHP design requirements will go into effect on the first day of plan years beginning on or after January 1, 2020.

Last month, the US Department of Health and Human Services (HHS) announced the inflation adjusted out-of-pocket (OOP) maximums that will apply to non-grandfathered health plans for plan years beginning in 2020. The OOP maximum includes the plan’s deductible, co-pays, coinsurance and other cost-sharing amounts for benefits that are considered essential health benefits under the Affordable Care Act (ACA).

The chart above shows the limits for 2019 and 2020. Please note that the HSA contribution limits apply to accountholders on a calendar year basis and are subject to proration based on monthly HSA eligibility. The HDHP and ACA limits shown apply to plan years which begin in the year specified.

If you have questions about the 2020 limits or other compliance concerns, please feel free to contact us at info@foster-foster.com or (630) 620-0200 ext. 508.