Foster & Foster monitors changes in legislation, regulations, and national trends to help our clients be prepared.

[smbtoolbar]

Foster & Foster Acquires Wisconsin-Based Key Benefit Concepts and California-Based Demsey, Filliger & Associates Deals Will Further Extend Foster & Foster’s Reach in the Midwest and West Coast Actuarial Consulting Markets

January 2, 2024IRS Issues New Mortality Table Regulations Effective January 1, 2024

November 4, 2023Update to Our Clients on COVID-19

As a country, we are rapidly adapting to the global pandemic of COVID-19. Foster & Foster is monitoring the situation to understand how the virus will impact our clients’ benefit plans. We would...

Read moreState Individual Mandates Add to Employer Reporting Responsibilities

In response to the federal government’s repeal of the financial penalties of the Affordable Care Act’s (ACA’s) Individual Mandate, several states have enacted their own individual mandates. Without...

Read moreYear-end Congressional Spending Bill Repeals ACA Taxes and Extends PCORI Fee

As part of a year-end spending bill that was signed in law last Friday, Congress passed a repeal of several ACA taxes, an extension of the PCORI fee, and a number of revisions to retirement savings...

Read moreSECURE Act Signed into Law

Last week saw the U.S. Senate pass an omnibus spending bill, which President Trump signed into law on Friday. Attached to this bill was the Setting Every Community Up for Retirement Enhancement Act...

Read moreIRS Announces Updates to 2020 Retirement Plan Limits

Each year the IRS provides cost of living adjustments to benefit plan limits to assist sponsors in administering their plans. On November 6, the IRS released Notice 2019-59, which provided 2020 limits...

Read moreFoster & Foster Expands Plan Administration Services to Illinois Fire and Police Pension Funds

Foster & Foster’s Plan Administration Division was established in Fort Myers, FL in 2013 and currently provides third-party administration services to over 40 Florida pension plans. The...

Read moreIRS Announces 2020 Flexible Spending Arrangement (FSA) Contribution Limit

The Internal Revenue Service (IRS) has announced that the 2020 limit on employee pre-tax FSA contributions will rise to $2,750, up from $2,700 in 2019. Revenue Procedure Bulletin 2019-44 provides the...

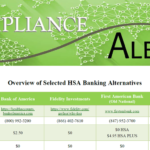

Read moreOverview of Selected HSA Banking Alternatives

We’re frequently asked which is “the best” HSA bank for our clients’ employees, but it’s not an easy answer. Lately, employers are moving away from using traditional...

Read moreSOA Mortality Tables Finalized for Private-Sector Retirement Plans

In May 2019, the Society of Actuaries (SOA) released an exposure draft of the Pri-2012 Mortality Tables for private-sector retirement plans. These new tables were based on data collected for 2010 –...

Read more